Rare Earths: four recipes for safe supply chains.

The growing demand for Rare Earths for energy transition requires more resilient supply chains. Are stockpiling and recycling

part of the solution?

In the coming years, energy transition and the progressive electrification of our economies will increase the consumption of Rare Earths and other elements, such as lithium, cobalt, nickel, and copper collectively indicated as critical raw materials. The growth in demand for critical raw materials, coupled with their production concentrated in a few countries, raises concerns about the security of their supply.

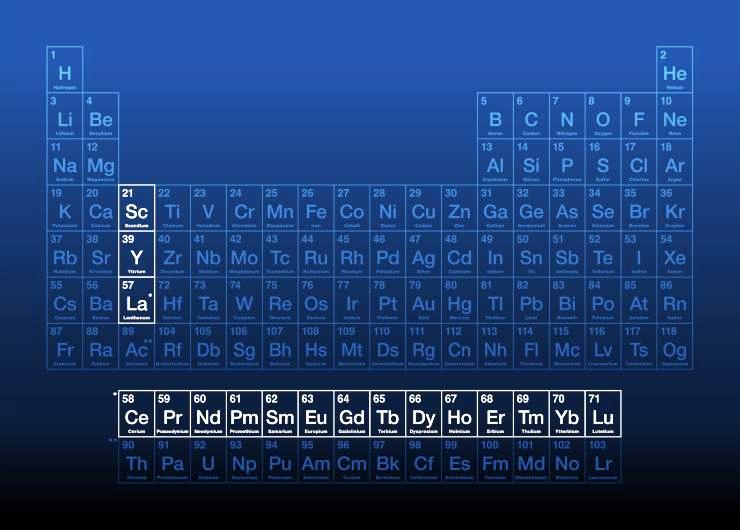

Rare Earths, despite their name, are not earths and are not rare, but a group of 17 elements of the periodic table: yttrium and scandium to which is added the lanthanide family. Elements such as praseodymium, neodymium, gadolinium, and holmium belong to the lanthanides, generally unknown to non-adepts of Mendeleev’s periodic table.

However, although little known, Rare Earths are needed for the construction of wind turbines, electric motors, magnets and electronic equipment, such as our smartphones. According to the American Chemical Society, an iPhone contains 16 Rare Earths even if, in total, they do not exceed 1% of the weight of a mobile phone.

The relative chemical similarity of the lanthanides makes them not easily separable from each other and consequently expensive to produce. The term rare, therefore, does not derive from the rarity of the earth, but from the complexity of the extraction process of the specific element from the mineral that contains it.

Then there are other critical raw materials such as lithium, cobalt, nickel and copper that do not belong to the Rare Earths, but whose demand will grow in an economy that will become increasingly electrified

and decarbonized.

For example, lithium-ion batteries, used in most electric cars, need around 10 kilograms of this element per battery. The manufacture of an electric car also requires tens of kilograms of copper. According to the International Energy Agency, the demand for lithium together with that of copper is destined to double between now and 2040.

More than 60% of Rare Earths are produced by China, but if we include refining processes, the percentage controlled by that country reaches almost 90%, generating concerns about our dependence on a substantial monopolist. It can be anecdotally recalled that in the 1980s the Chinese leader Deng Xiaoping clairvoyantly stated: “the Middle East has oil and we have Rare Earths”.

For other critical raw materials, the centre of gravity is located in Latin America, which has 50% of lithium reserves, 40% of copper and a quarter of nickel. Lithium, in particular, is concentrated in Argentina, Chile, Bolivia and Brazil and these countries are discussing the creation of a lithium cartel modelled on the OPEC oil cartel.

It is therefore vital that our energy security mechanisms, designed for hydrocarbon supplies, are modernized considering the new risks of a more electrified, more decarbonised society with an increasingly important role for critical raw materials. In this regard, it may be useful to analyze similarities and differences between the market dynamics of oil, the strategic commodity par excellence, and critical raw materials, the new commodities of the energy transition.

Firstly, as with oil, reserves and production of critical raw materials are concentrated in a limited number of countries. However, while for oil OPEC, a cartel of 13 countries, controls only a third of global production, for some critical commodities production is concentrated in a smaller number of countries. For lithium, cobalt and Rare Earths, the three largest producers control three-quarters of global production.

Secondly, both critical raw materials and oil require more than a decade between the discovery and the start of production in new fields. This dynamic can trigger the so-called commodity supercycle whereby the price of raw material continues to increase due to growing demand and a supply that is unable to satisfy it in the short term.

One example of a supercycle was the rise in the price of oil from $10 to $140 a barrel between 1999 and 2008 as a result of growing demand and supply that could not keep up.

A third analogy is the decline in the quality of resources and reserves which can in some cases, but not always, be compensated for by technological developments. For example, at the end of the 19th century in Andalusia, the Rio Tinto company produced copper from rocks with a percentage amount of copper in the rock mass, the so-called “tenor”, of 15%. In current mines, the content is less than 1% and to obtain a few kilos of copper it is necessary to process a ton of rock, with significantly high cost and environmental

However, there are also differences between oil and critical raw materials. Petroleum is not recyclable, except for a percentage of about 10% used for plastic materials. The remaining 90% is burned in various forms and therefore cannot be reused. For critical raw materials, however, in many cases, there is the possibility of recycling.

Finally, the dynamics of use are different: if the oil supply were to be interrupted, our transport and therefore our economies would immediately be blocked.

In the case of critical raw materials, only new productions would be interrupted, but the already existing fleet of wind turbines and electric motors, to cite two examples, would continue to operate.

Considering the similarities between oil and critical raw materials, we could take as a model the policies implemented after the oil shocks of the 1970s to increase the security of supplies of these materials.

In the 1970s when oil soared from $3 to $40 a barrel, new fields were brought into production in the North Sea, Alaska and the Gulf of Mexico. These fields put 6 million barrels of non-OPEC oil on the market, helping to push the price of crude below $10. Similarly, the production of critical raw materials in the European Union should be encouraged in the coming years. The discovery of significant quantities of lithium in the Czech Republic, estimated at 3% of global deposits, was recently announced. If these resources are not available in Europe, it will be necessary to ensure diversified supplies from reliable third countries.

Another policy from the 1970s aimed at reducing oil consumption by replacing it with other sources of energy and implementing energy-saving initiatives.

In the case of critical raw materials, efforts should be made to use them more efficiently and to recycle them in a circular economy perspective, consequently reducing imports from third countries.

Furthermore, in the 1970s strategic oil stocks were created with which importing countries acquired sufficient resources to compensate for a 90-day import cancellation.

Consideration should be given to building strategic stockpiles of critical raw materials both in the EU and in OECD countries, modelled on the oil stockpiles created in the 1970s.

Finally, it may be recalled that on 16 March 2023, as part of the Green Deal industrial plan, the European Commission adopted a legislative package on critical raw materials. The package includes initiatives to ensure secure, diversified, affordable and sustainable access to the critical raw materials needed precisely for the energy transition. (Photo:123rf)

Massimo Lombardini

ISPI