The Kimberley Process. The stones of conflict.

The West aims to sanction the Kremlin also in the diamond market of which Russia is the main producer. Among those directly affected are Botswana, Angola and Zimbabwe.

Trying to classify Russian diamonds as conflict diamonds to limit their foreign trade as much as possible: the failed attempt took place from 6 to 10 November in Victoria Falls, Zimbabwe, on the occasion of the last annual meeting of the Kimberley Process (Kp), the international certification agreement which since 2000 aims to guarantee that proceeds from the sale of diamonds do not end up in the hands of rebel movements, terrorist groups or criminal organizations.

The meeting, in which the 85 countries adhering to the agreement and which together cover 99.8% of the global production of rough diamonds were represented, marked yet another rift at an international level over new sanctions to be inflicted on Moscow in response to the aggression of Ukraine that began in February 2022.

In 2022, 51.40% of global diamond production was concentrated in Africa. File swm

At the Victoria Falls meeting, what can be termed as the Western Front, led by the European Union, the United Kingdom and the United States, proposed to broaden the definition of conflict diamonds to include precious stones sold to finance the military invasion of a state by of another, also through the use of the regular army. The measure, tailor-made to strike the Kremlin, as expected, however, was blocked by the principle of unanimity which conditions the vote for any proposed amendment to the Kimberley Process regulation. In fact, Moscow had no difficulty in gathering a handful of votes against the proposal. Belarus and Kyrgyzstan, China and several African countries in which the Russian giant Alrosa operates have aligned themselves with its diktat.

Botswana immediately paid the price for the stalemate. At the urging of the Belgian company HB Antwerp, the government of Gaborone, which hosts the permanent secretariat of the Kimberley Process as of January 1, 2024, supported the Western cartel. The ball is now in the court of the United Arab Emirates, which has assumed the rotating presidency of the body at the beginning of 2024. On the possibility of restricting Russian diamond exports Ahmed Bin Sulayem, head of the free trade zone Dubai Multi Commodities Centre, was clear: “Geopolitical gridlock cannot be allowed to hinder the crucial work of the Kimberley Process.” In short, the agreement is not to be altered.

The market split in two

The global diamond market thus finds itself split in two. On the one hand, there are the G7 leaders who at the beginning of December reached an agreement to limit imports of Russian diamonds from 2024. From March this year, the restriction will also be extended to precious stones processed in third countries and simultaneously controls will be increased to guarantee the general traceability of what is placed on the market.It is the African countries that are most concerned that they will suffer the consequences of this crackdown on Moscow. The African Diamond Producers Association (Adpa), an intergovernmental organization made up of 15 member states and 5 observers (including Russia), has spoken out against the attempt to use the Kimberley Process platform to sanction the Kremlin.

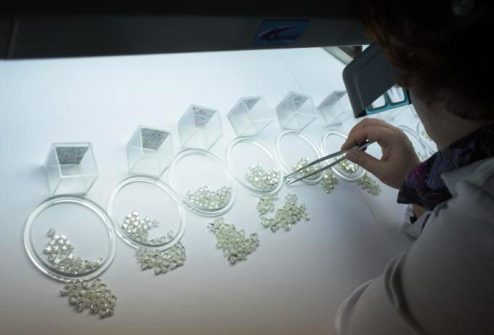

Rough diamond sorting. ALROSA is one of the largest diamond companies in the world. Photo: Alrosa

But in this game, Africa can aspire to play a much more active part than being simply a mining continent. This is stated by the latest KP estimates according to which in 2022, 51.40% of global diamond production was concentrated on the continent, where 66.40% of the global value of this business also stands. Eight of the top ten producing countries are African. The second, behind Russia, is Botswana with 24.8 million carats extracted, whose commercial value, however, is much higher (almost 5 billion dollars compared to around 3.5 billion in Moscow). If in Botswana the bulk of production is in the hands of Debswana, a joint venture between the South African group De Beers and the Gaborone government, in Zimbabwe (seventh in production and value) and Angola (sixth in production and third in value) Alrosa is in pole position.

Artisanal miners in Angola. File swm

In the Angolan mine of Catoca in 2022, the Russian company extracted around 6 million carats worth around 1.2 billion dollars. Although Alrosa’s presence remains well-rooted in Africa, the effect of sanctions on Russia is pushing more and more countries to loosen or review relations with the Russian giant. Behind it, there is an element of economic rather than diplomatic opportunism. Today a diamond identified as not coming from a mining chain involving Russian players is worth much more since this guarantees it access to central markets such as that of Antwerp, where precious stones worth 26 billion dollars are traded every year. Since the invasion of Ukraine, Russian diamonds in Antwerp have lost 95% of their market share. This has inevitably made any form of collaboration with Russian companies uncomfortable, if not “toxic”, even for African countries. With the war in Ukraine set to last for a long time, choosing which side of the market to take will be more important than ever. (Open Phot: 123rf)

Rocco Bellantone